A mortgage modification allows you to negotiate with a mortgage lender and reduce your payments, avoiding serious legal consequences of defaulting on a payment, like foreclosure. However, it’s not always an easy process. First, you need to qualify for a mortgage reduction or modification. Even then, it helps to have representation from a mortgage attorney so they can see that everything happens within your legal rights.

A bankruptcy lawyer from a firm like Sawin & Shea can help you with a mortgage dispute and help with mortgage lenders so you can avoid foreclosure and set yourself up for success in the mortgage process of modification.

To get a free consultation from one of our attorneys, call 317-759-1483.

What Qualifies You for Mortgage Modification?

In recent years, the rise of property purchases and home closing has meant that many people are real property owners for the first time. However, real estate transactions are complicated, and not everyone understands what they are getting into.

Even with federal laws that prohibit predatory lending, the mortgage industry is not error-free, and there are cases where a buyer doesn’t understand the full weight of the contracts they signed. This can lead to disputes and issues paying mortgages.

If you purchase a property and uncover errors or struggle to make payments on your mortgage, then a modification could be right for you. An attorney can help you go through your options and explain legal consequences of short sale, foreclosure, or bankruptcy.

Common Qualification Requirements:

Not all borrowers who are struggling to pay a mortgage loan will qualify for a modification to their existing contract.

When disputes arise regarding mortgage contracts and payments, parties are required to meet certain requirements to qualify for potential loan modification. Some of the common requirements include:

Your Mortgage Is About To Default

The loan must be about to default or be at risk of defaulting. If your mortgage is paid and the contract isn’t about to go into default, then you won’t qualify for modification. In this case, working with a bankruptcy attorney can help you avoid serious consequences.

You Are Legally Responsible for Your Loan

The borrowers on the loan must be the ones applying for the modification, not a co-signer or someone wanting to represent them but who isn’t involved in the loan. In most cases, they must also be the owners of the real estate that the mortgage secures.

You Are Going Through Financial Hardships

The buyer must also be going through a specific financial hardship that has led to the default or risk of default, not just forgotten payments or neglecting to follow through at the bank after a home purchase.

For example, a financial hardship could include:

- Disability

- Long-term illness

- Death of a family member

- Loss of income

- Housing cost increases

- Property tax increases

- Divorce

- Natural disasters

Your Mortgage Is Backed by a Federal Program

If a property purchase was through certain federal loan programs, like Fannie Mae and Freddie Mac, then the lender may tell you that you qualify for a government modification program. Bankruptcy attorneys may be able to guide you in understanding if the purchased property falls under these categories.

You Will Be Able To Make the New Payments

Many lenders will require proof that you can pay the new monthly payments of your negotiated loan before the litigation process delivers a final judgment. This shows that no one is attempting to commit mortgage fraud and protects the lender for future business.

Document Requirements

In addition to meeting most, if not all, of the previous qualifications, the mortgage lender will also require additional legal documents and applications before they seriously consider taking on modification disputes.

Some of those documents include:

- Your current bank statements and a summary of your finances

- The estimated value of the property

- Tax returns for the last several years

- Proof of income, such as pay stubs

- The real estate contract or title company contract from the home sale

- A letter explaining your current financial hardships

- Supporting documentation (medical bills, divorce decrees, death certificates, etc.)

When You Need a Lawyer To Help Secure a Modification

The legal ramifications of mortgage fraud or default can be devastating. Trying to manage mortgage disputes and navigate federal and property laws can be incredibly overwhelming, especially when you are dealing with additional hardship.

A bankruptcy attorney can help you by providing legal services that expressly deal with the issues that arise with mortgage modification and the legal issues involved with mortgage lenders.

How a Lawyer Can Help With Modification:

A bankruptcy attorney can help you navigate property law and make sure that if your case goes to litigation, you have legal representation on your side. A bankruptcy attorney is also able to help you work through the complicated steps of a mortgage modification, such as:

Loan Application and Paperwork

Bankruptcy attorneys can help you go through the paperwork and forms needed for modification, and the mortgage lawyers’ experience can help you avoid errors and mistakes that could cause issues in litigation.

Working with Mortgage Companies

Bankruptcy attorneys know how to work with different mortgage companies. The mortgage lawyer knows the ins and outs of property contracts, buyer rights, and federal laws based on class actions that have developed over the years. They will know if the lender has violated the law and if the present case gives their clients an edge over the lender institution.

Appealing Denials

If the mortgage modification is denied, a bankruptcy attorney can represent the buyer in appeals litigation, giving them a chance to file against the initial ruling. The mortgage lawyer will know the details of the parties involved and can help mortgage lending clients with detailed arguments, as they already know your business.

Providing Legal Experience and Guidance

Not every issue requires a loan modification. There are times when a bankruptcy attorney might suggest going in a different direction or pursuing a different approach to avoid foreclosure.

For example, if a lender has done something egregious, then the class actions approach might be better, or trying to turn the sale of the house into money that can pay down a loan.

No matter what you choose to do with mortgages, deciding to hire a bankruptcy attorney can help you avoid unnecessary stress and have someone on your side who knows the law and will represent your interests.

Real Estate Attorney Cost

If you are worried about adding the cost of a mortgage lawyer on top of your existing financial issues, don’t overthink it. Just like working with a real estate agent, a bankruptcy attorney will work with you and your financial situation so you are comfortable with the final cost. The attorney will be upfront so you can make an informed decision before accepting legal advice.

How Loan Modification Negotiation Works

Now that you know how a bankruptcy attorney can help, let’s talk about how the modification negotiation process works. There are a few key ways how the modification can end:

Extend the Repayment Period

First, the modification can extend your repayment period, which can reduce interest or your monthly payments.

Convert the Mortgage

Another option that a bankruptcy attorney can help you negotiate is to convert your loan into a fixed-rate mortgage from an adjustable rate, helping you avoid increasing interest rates.

Reduce the Principal of the Loan

While rare, there are cases where a bankruptcy attorney can help you take the principal off of the loan, which reduces your total owed and lowers the monthly payment.

Refinance the Loan

Refinancing the loan isn’t technically a modification, but it’s a method where your lawyers will work with the lender to create a new loan, usually by combining or selling assets. You may also be required to convert the sale of other property in case of default.

Reduce the Interest Rate

Finally, an attorney might convince the lender to reduce the interest, so that federal rate increases aren’t as damaging to your payment plan. While not all lending business operators will be open to this, it can potentially be negotiated through your attorneys.

How Do You Request a Mortgage Modification?

If you want to start modification, you have to make sure you meet the qualifications. While bankruptcy attorneys can help you figure out if you qualify, ultimately the decision is up to you.

How To Start the Process:

If you decide you want to move forward with the business of applying for a modification, there are a few ways to start.

- Speak With the Lender Directly: Reach out directly to your lender and mention that you want to discuss the modification process. Ask if they have a form or paperwork that you can start filling out.

- Hold a Foreclosure Conference: If your home is already in foreclosure, you may need to meet with a judicial conference and talk through alternatives with your legal team. Based on the laws of your county, this may or may not be a realistic option.

- Find Modification Programs: Certain streamlined or federal programs can help you qualify for modification. Your lawyers will be able to help you find these programs and determine if you qualify, as it is their business to be up-to-date on how to best serve clients.

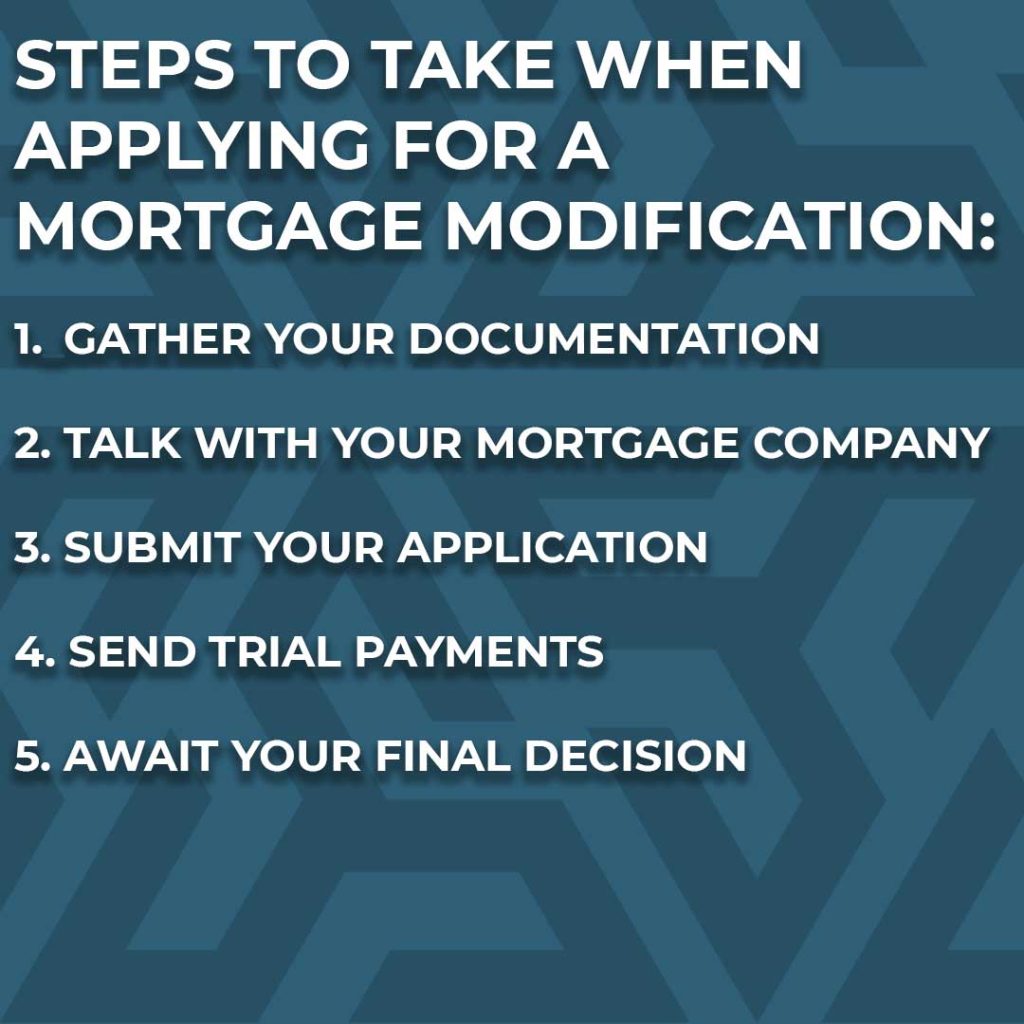

Steps To Take When Applying for a Mortgage Modification

After reaching out, it’s time to follow through on the steps of mortgage modification.

- Gather Your Documentation: Collect all of your contracts, paperwork, and documentation. Your attorney will put it together and prepare everything to hand over to the lending business. Collect all of your contracts, paperwork, and documentation. Your attorney will put it together and prepare everything to hand over to the lending business.

- Talk with Your Mortgage Company: Make sure your lender knows that the application is coming so they aren’t taken by surprise.

- Submit Your Application: Have your attorney send in the official form or application, along with all of your supporting documentation.

- Send Trial Payments: Many business operators will require you to pay a few months’ worth of your renegotiated mortgage purchase, so they can confirm you are good for the money.

- Await Your Final Decision: Wait for the final decision to come from the lending institution on whether or not they accept your application. If they reject it, your lawyer can file an appeal.

How Does a Mortgage Modification Affect Your Credit?

A mortgage modification can potentially damage your credit. However, if you are at risk of a default in a property purchase, it’s much better to take a hit to your credit than risk bankruptcy. Your attorney will likely advise you of the same.

Contact a Sawin & Shea Mortgage Attorney in Indianapolis

At the Law Firm of Sawin & Shea, we work hard to protect home buyers and give you legal advice and support from our team of bankruptcy lawyers. We want to help you avoid foreclosure and the loss of your property, which is why our attorneys are always available to help you.

For a free consultation with a Sawin & Shea attorney to answer any questions that may arise, call 317-759-1483 today.