Filing for bankruptcy is frequently a powerful debt relief option for those living in Carmel, Indiana. Despite its bad reputation, bankruptcy can eliminate most debts, enabling you to have a fresh start and improve your financial situation.

For bankruptcy services in Indianapolis, Carmel, and other parts of Central Indiana, contact the bankruptcy lawyers at the law firm of Sawin & Shea, LLC. Our bankruptcy attorneys have years of experience serving Carmel residents. Our law firm of bankruptcy lawyers serving Carmel, is ready to help you through the bankruptcy process.

Why You Should Hire a Bankruptcy Attorney in Carmel, IN

Some of the primary sources of overwhelming debt for Indiana residents include costly medical bills, devastating property damage, lost income, and divorce. A Carmel bankruptcy lawyer can help you get through your bankruptcy and plan for your financial future.

You are not required to retain a Carmel bankruptcy lawyer to file. That said, bankruptcy filings are often complex, and an experienced Carmel bankruptcy attorney can help ensure you file correctly. Otherwise, the Indianapolis bankruptcy court could deny your debt discharge if you make a mistake.

An Indiana bankruptcy attorney can help you by enforcing the automatic stay. Bankruptcy law dictates that anyone filing gets instant protection from creditors and creditor actions, such as a home foreclosure, wage garnishment, or lawsuit. Bankruptcy attorneys protect their clients from creditor harassment.

Carmel clients can schedule their free consultation today with our bankruptcy lawyers online or by calling our Indianapolis law firm at 317-759-1483.

Sawin & Shea Bankruptcy Lawyers: How We Can Help

Chapter 13 Bankruptcy

Chapter 13 bankruptcy in Carmel involves repaying creditors something through a three-to-five-year payment plan. When filing, you agree to pay back a portion of your debts in monthly installments. Your exact payment plan will depend on your income and assets. A Chapter 13 plan can also help people get caught up on things like houses and cars. Once you complete the monthly payments, you can discharge your remaining eligible debts owed to creditors.

This form of bankruptcy is ideal for eliminating debt while halting an Indianapolis house foreclosure or vehicle repossession, as Chapter 13 bankruptcy filers often have equity in their home or car. It’s an exceptional option for high-income earners who don’t qualify for Chapter 7 bankruptcy because of their assets.

Chapter 7 Bankruptcy

Carmel clients who file Chapter 7 can discharge all eligible debts without needing to repay them, including missed medical payments, outstanding credit card balances, unsecured loans, and other debts. That said, you could lose certain assets and possessions.

Chapter 7 bankruptcy is often referred to as liquidation bankruptcy. Some exempt assets in Indiana include $22,750 in home equity, $12,100 in tangible personal property, and $450 in intangible property which are cash or cash equivalents.

In order to qualify for Chapter 7 bankruptcy, clients must undergo a means test. The means test will quantify your monthly income from any job or business in comparison with the median income in Indiana. If your income is too high, you will not qualify for Chapter 7, but you can file for Chapter 13 instead.

Mortgage Modification

A mortgage modification is an agreement between you and your lender to adjust your mortgage. These are often a great option for those who have missed mortgage payments or are at risk of missing future payments.

Mortgage modifications are possible while in a Chapter 13 filing. Clients can return to good standing and make your monthly payments more affordable through a mortgage modification.

Student Loan Rehabilitation

Those struggling with student loan defaults can repair their loan standing through student loan rehabilitation. With student loan rehabilitation, you agree to pay monthly installments to rectify the loan default. You must make nine payments over ten months.

The Indianapolis bankruptcy attorneys at Sawin & Shea can assist you in navigating your debt reduction so that you can concentrate on getting the student loans back on track and we can help you determine your best course of action for becoming debt-free.

Living in Carmel, IN

Carmel is located in Hamilton County, the second-wealthiest county in Indiana. The city features exceptional educational opportunities, a thriving economy, and a pleasant suburban atmosphere.

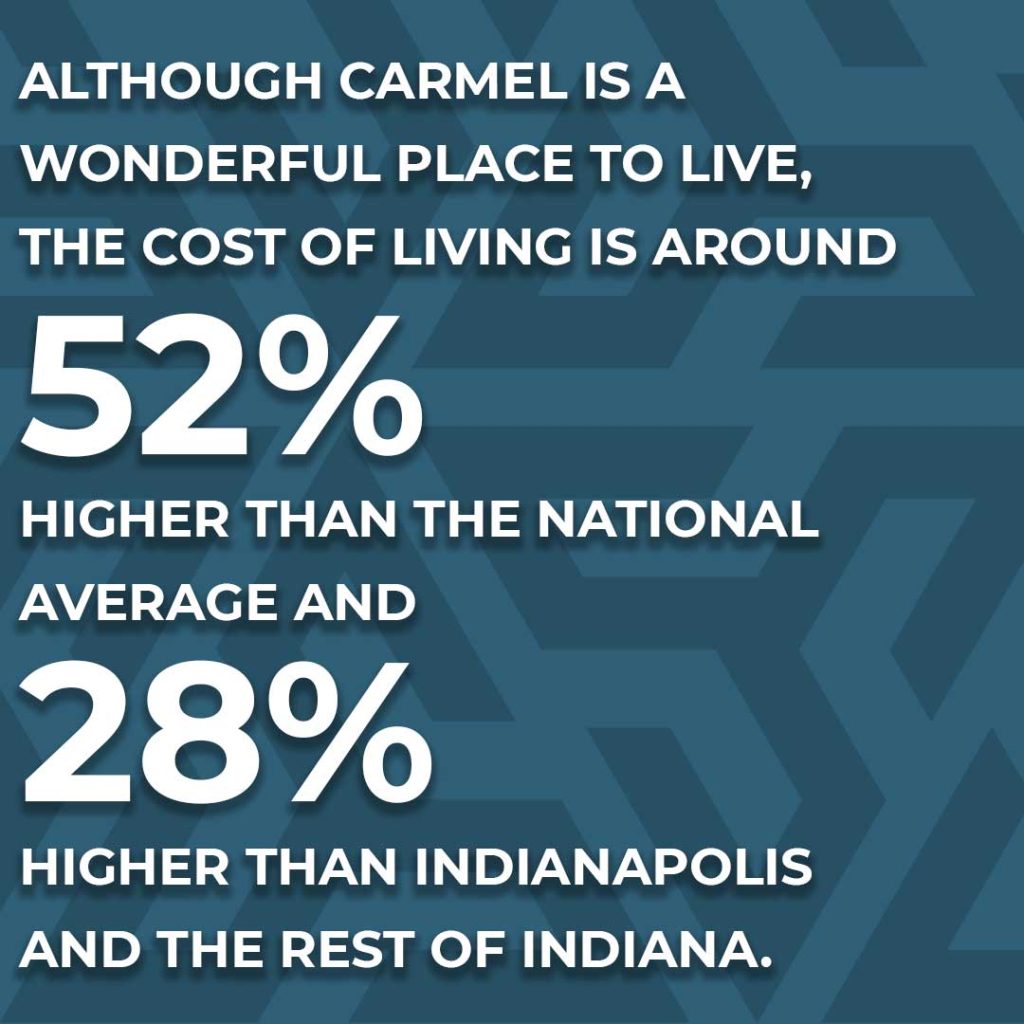

Unfortunately, Carmel and Hamilton County are also expensive. One of the main reasons why Carmel, Indiana, residents struggle with debts is due to the city’s high cost of living. Although Carmel is a wonderful place to live, the cost of living is around 52% higher than the national average and 28% higher than Indianapolis and the rest of Indiana.

If you’re struggling with overwhelming debt, you may want to consider Chapter 7 or 13 bankruptcy. Get in touch with the Sawin & Shea bankruptcy attorneys serving Carmel today.

Carmel, Indiana Court Location

1000 South Rangeline Road

Carmel, IN 46032

317-571-2440

www.carmel.in.gov/government/court

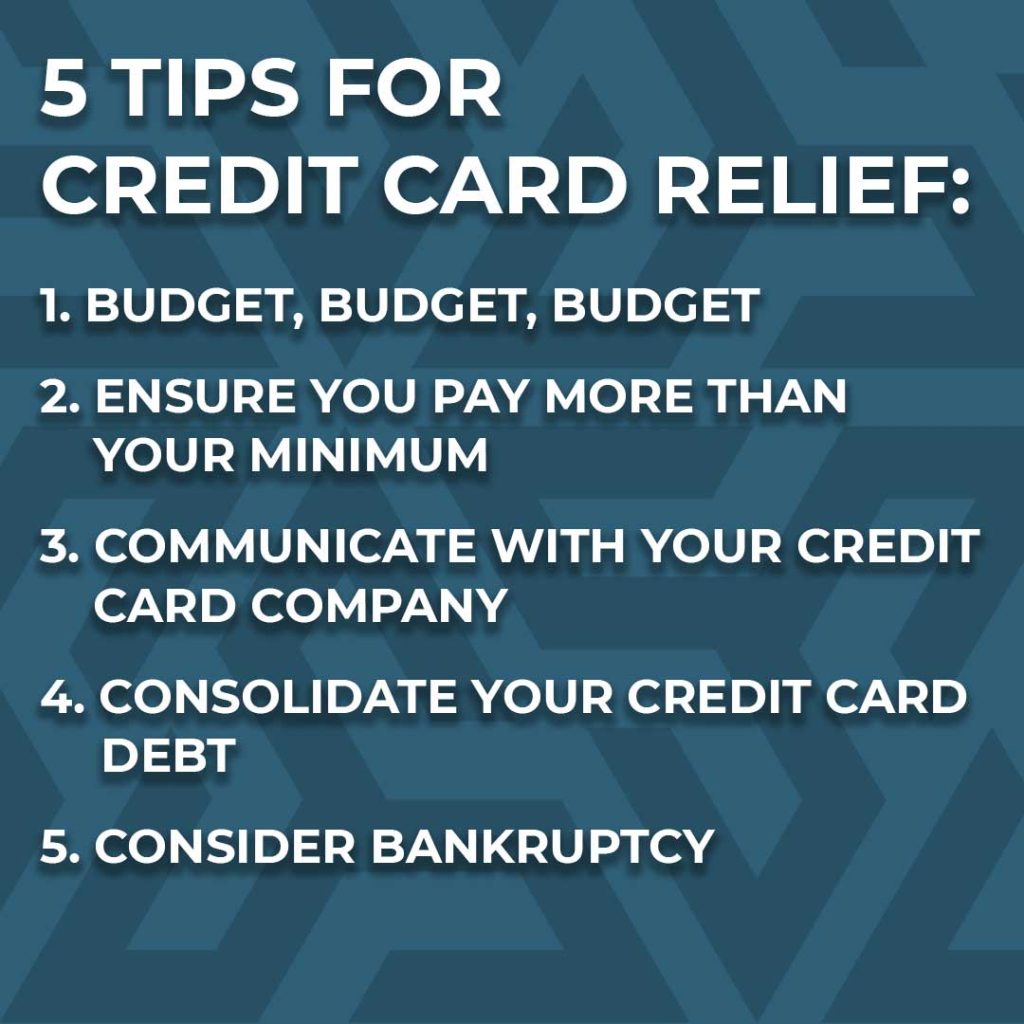

5 Tips for Credit Card Relief

Credit card debt is a serious epidemic in the United States, as Americans have over $1 trillion in credit card debt! If you’re struggling with disheartening credit card balances in Carmel, you’re not alone. Here are five tips for overcoming credit card dues:

- Budget, budget, budget: Perhaps the most important thing you can do to overcome your credit card debt is to ensure you make more money than you spend.

- Ensure you pay more than the minimum: When creating your budget, make sure you pay more than just your minimum credit card payment. Create an airtight budget that reduces your principal as much as possible each month.

- Communicate with your credit card company: Explaining your financial situation to your credit card company could lead to them having some leniency with an approaching penalty. They may even lower your interest rate.

- Consolidate your credit card debt: You can make your credit balances more manageable by consolidating your debt into a lower-interest personal loan.

- Consider bankruptcy: If your credit card balances have become too much to handle, it may be time to consider bankruptcy. Unpaid credit card balances are unsecured debts, meaning they’re eligible for discharge once you complete Chapter 7 or Chapter 13 bankruptcy.

Bankruptcy FAQs

How Much Debt Is Needed To File for Bankruptcy

There is no minimum amount of debt required to file for bankruptcy in Carmel. Still, bankruptcy filings are not right for everyone. A common question that people have regarding filing is “Will bankruptcy affect your credit?” and the answer is “Yes.” Your bankruptcy will negatively impact your credit for up to ten years. For that reason, you should only consider bankruptcy if it’s necessary to overcome your debts.

Debt Consolidation vs Bankruptcy: Which is Better?

Whether to choose debt consolidation or bankruptcy depends on your specific debts and amounts. Not all debts are eligible for discharge in bankruptcy, such as certain student loans and tax penalties. Consolidation may be better for smaller amounts of debt, but consider personal bankruptcy if you can’t realistically repay them.

What Should I Know About Medical Debt and Bankruptcy?

Medical debt is one of the most significant sources of financial stress for Americans. Two-thirds of those who file bankruptcy in the United States cite this form of debt as their primary problem.

Fortunately, bankruptcy cases do discharge medical debts. With Chapter 7, you can discharge this debt after the liquidation process. In most cases of Chapter 13, you’ll need to undergo the three-to-five-year repayment plan before discharging this debt under this bankruptcy chapter.

Contact Bankruptcy Attorneys Serving Carmel, Indiana Today

If you’re considering filing for personal bankruptcy in Carmel, Indiana, contact the bankruptcy lawyers at Sawin & Shea, LLC. We have years of experience serving Carmel with our legal services, and we can help you on your path to becoming debt-free by filing Chapter 7 or Chapter 13.

Schedule your free consultation today by calling our law office at 317-759-1483, or request your legal counsel appointment with our bankruptcy lawyers online here.