Bankruptcy and Unemployment

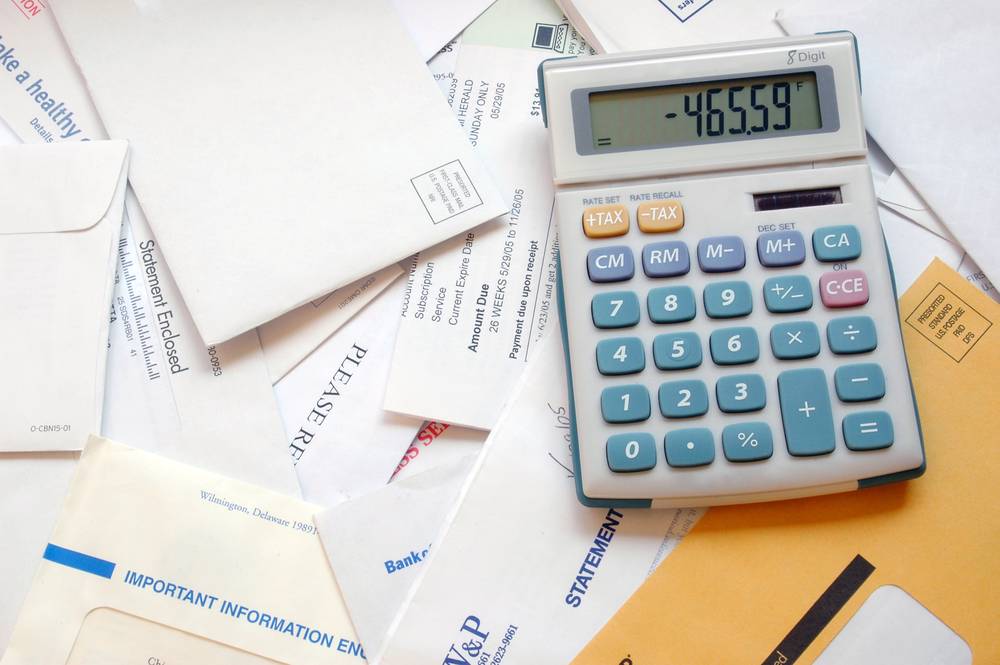

Are you dealing with the double battle of losing your job while deeply in debt? Now you’ve lost your source of income while already struggling to pay your bills. In this situation, you may be wondering whether bankruptcy could be a good solution. After all, it’s nearly impossible to make progress on paying down your … Read More