Bankruptcy Attorney in Anderson, Indiana

Overwhelming debt can negatively impact almost every aspect of your personal life. It can even negatively affect your relationships and family, as financial problems are a leading cause of divorce in the United States.

Fortunately, you have options—those struggling with credit card debt, medical bills you haven’t paid, and other missed payments can file for bankruptcy. Filing for bankruptcy with the help of a bankruptcy lawyer can provide you with a fresh start while also protecting you from foreclosure, vehicle repossession, wage garnishment, and other creditor actions in Anderson, Indiana. Contact Sawin & Shea Law today for a free consultation with a bankruptcy lawyer.

How a Bankruptcy Lawyer in Anderson, IN Can Help

Technically, you do not need a bankruptcy lawyer to file, but bankruptcy cases are incredibly complex. You may be confident in your ability to research bankruptcy law and file yourself, but the truth is that a bankruptcy attorney will be invaluable for your case. Those who have filed petitions in bankruptcy court without legal support from a lawyer have often made mistakes, causing further financial and legal problems. It’s best to hire an Anderson bankruptcy attorney to assist you.

At the law firm of Sawin & Shea, LLC, we assist residents of Anderson, Indianapolis, and other cities in Indiana with dependable bankruptcy law guidance. An Anderson bankruptcy attorney on our team can help you through the entire bankruptcy process, empowering you to eventually live your life free of debt.

Our team can help you with both Chapter 7 and Chapter 13. The key differences between the two bankruptcy filing methods are income and retention of certain resources. Those filing Ch 7 bankruptcy in Anderson or Indianapolis liquidate their nonexempt assets to discharge unsecured debts. When you file through this method, the bankruptcy court will assign a trustee to your case. This trustee will be in charge of liquidating your belongings to repay creditors for debts and unpaid bills. That said, most of our clients who filed Ch 7 were able to retain most if not all of their possessions.

In contrast, Chapter 13 involves creating payment plans to repay creditors. Ch 13 payment plans depend on a person’s disposable income. Under this bankruptcy filing method, you will pay back a portion of your credit debts to creditors over three to five years.

In contrast, Chapter 13 involves creating payment plans to repay creditors. Ch 13 payment plans depend on a person’s disposable income. Under this bankruptcy filing method, you will pay back a portion of your credit debts to creditors over three to five years.

After undergoing Chapter 7 or Chapter 13 bankruptcy, you can discharge certain debts, such as overwhelming credit card and medical debt. You will also be granted an automatic stay when you file. This automatic stay protects you from wage garnishment, creditor lawsuits, creditor calls, home foreclosure, vehicle repossession, and other creditor actions.

In addition to helping Indiana residents with bankruptcy law, an Anderson bankruptcy attorney at Sawin & Shea Law Firm can assist in related practice areas, including student loan rehabilitation and creditor harassment. Sadly, individuals can only discharge student loan debt if the debt is creating overwhelming financial hardships. Still, an experienced bankruptcy lawyer on our team can help you and present different legal options for overcoming this debt.

You can request a free consultation with an experienced Anderson bankruptcy attorney by calling our firm at (317) 759-1483 or contacting us here.

Living in Anderson, IN

Anderson is located in central Indiana, serving as the county seat of Madison County. The city is known for its rich history and features the breathtaking Downtown Historic District. Residents and visitors can see iconic sights, such as the Paramount Theatre, Gruenewald House, and the Anderson Museum of Art.

Downtown Anderson also boasts numerous local eateries, cafes, breweries, and weekly markets, competing with Indianapolis as a staple of vibrant community life in the central Indiana area.

While there’s much to see and enjoy in Anderson, the city maintains a small-town, suburban feel, perfect for families. Further, it’s situated conveniently just 50 minutes northeast of Indianapolis.

Anderson is also known for its many edifying educational opportunities. The city’s notable educational institutions include Anderson University, Anderson Preparatory Academy, Anderson High School, and Anderson Middle School. Plus, Anderson features an Ivy Tech Community College campus as well as Purdue Polytechnic Anderson.

Anderson, Indiana Court Location

Anderson City Court

1034 Main Street

PO Box 2100

Anderson, IN 46018

(765) 648-6078

Anderson, IN Bankruptcy FAQ

Will You Lose All Your Assets If You File for Bankruptcy?

The assets you can expect to lose when filing for bankruptcy will depend on your filing method. Debtors filing Chapter 13 bankruptcy will be able to retain all resources, as they will pay back a portion of their debts to creditors through three to five year payment plans.

The assets you can expect to lose when filing for bankruptcy will depend on your filing method. Debtors filing Chapter 13 bankruptcy will be able to retain all resources, as they will pay back a portion of their debts to creditors through three to five year payment plans.

Individuals who file Ch 7 bankruptcy can potentially lose nonexempt assets. The Chapter 7 bankruptcy trustee will sell the filer’s nonexempt effects to repay creditors.

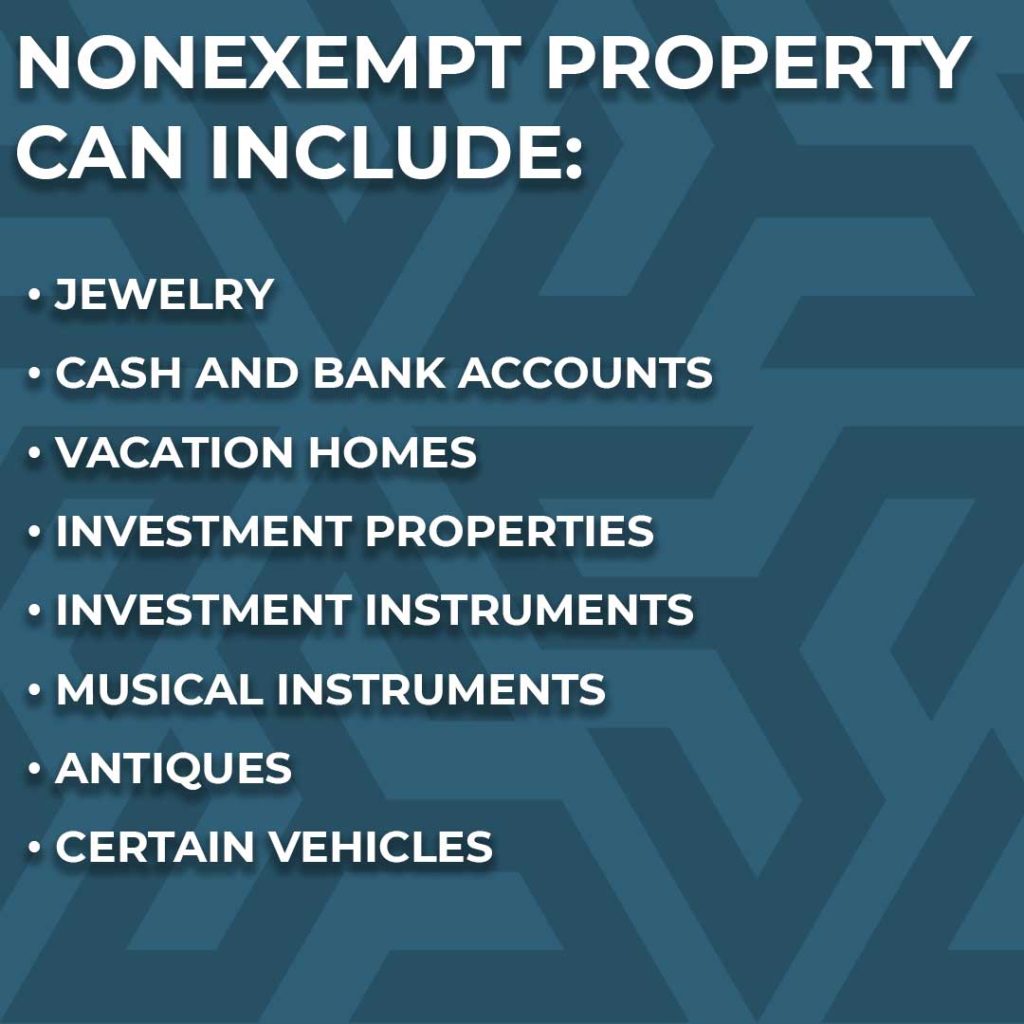

Nonexempt property can include:

- Jewelry

- Cash and bank accounts

- Vacation homes

- Investment properties

- Investment instruments, like stocks and bonds

- Musical instruments

- Antiques

- Certain vehicles

Fortunately, Anderson bankruptcy law does allow those who filed to retain certain types of effects. The Indiana Homestead Exemption enables a person filing for Chapter 7 bankruptcy to keep up to $22,750 in equity on a home or residential personal property, such as a mobile home. Spouses filing jointly can protect $45,500 in equity.

Fortunately, Anderson bankruptcy law does allow those who filed to retain certain types of effects. The Indiana Homestead Exemption enables a person filing for Chapter 7 bankruptcy to keep up to $22,750 in equity on a home or residential personal property, such as a mobile home. Spouses filing jointly can protect $45,500 in equity.

Indiana also offers the Wildcard Exemption. Bankruptcy Code § 34-55-10-2(c)(2) details that a person may protect up to $12,100 per person in nonresidential real estate, such as a rental or vacation property, or other tangible personal property. Further, the Indiana Wildcard Exemption allows a person to retain $450 per person worth of intangible resources, such as cash, money in bank accounts, claims against others, tax refunds, investment instruments and digital assets.

Some additional exemptions include:

- Certain retirement accounts and pensions

- Education savings account

- Military equipment, arms, and uniforms

- Health aids

- Various types of insurance benefits

- Unemployment compensation benefits

You can view our complete list of Indiana bankruptcy exemptions and nonexempt assets here.

If you have questions regarding exempt and nonexempt estate, you should schedule a free consultation with an Anderson bankruptcy attorney. A bankruptcy lawyer can also help you determine which debt-relief filing method is best for your financial situation.

You can discuss your property and the bankruptcy process in general with the experienced bankruptcy lawyers at Sawin & Shea Law. Request a free consultation with a lawyer today.

What Debts Can be Discharged in Bankruptcy?

Bankruptcy is a tremendous debt-relief option for many, as it allows you to discharge unsecured debts. Dischargeable debts in bankruptcy include:

- Credit card debt

- Medical debt

- Unpaid utility bills

- Payday loans

- Personal loans owed to friends, family members, and other individuals

- Certain missed tax payments and penalties

- Debt owed to collection agencies

- Some attorney fees

Although you cannot discharge all forms of debt, removing unsecured debts enables you to focus on repaying your non-dischargeable obligations. This will bring you closer to becoming debt-free with a fresh start.

Contact a Bankruptcy Attorney in Anderson, IN Today

Here at Sawin & Shea, LLC, our Anderson bankruptcy attorneys explain and simplify the process of filing for bankruptcy. We provide our clients with personalized attention as they pursue debt relief. Our law firm of Anderson bankruptcy lawyers proudly serves residents of Anderson, Madison County, Indianapolis, and the greater Indianapolis area.

Here at Sawin & Shea, LLC, our Anderson bankruptcy attorneys explain and simplify the process of filing for bankruptcy. We provide our clients with personalized attention as they pursue debt relief. Our law firm of Anderson bankruptcy lawyers proudly serves residents of Anderson, Madison County, Indianapolis, and the greater Indianapolis area.

With over 75 years of combined experience, we’ve helped thousands of people struggling with overwhelming debt across Indiana as they underwent complex bankruptcy cases.

One of our dedicated Anderson bankruptcy attorneys can assist you through the entire bankruptcy legal process as you pursue debt relief. Your Anderson bankruptcy attorney will help you file paperwork and represent you in bankruptcy court, helping ensure you file bankruptcy correctly in the Southern District of Indiana.

Clients can request a free consultation with an Anderson bankruptcy attorney today by calling us at (317) 759-1483, or you can reach us here. Our Anderson bankruptcy lawyers also offer weekend and evening appointments as well as $0 down attorney fees in qualifying cases.